Your 30s are a powerful decade, a time when careers gain momentum, families begin to grow, and financial decisions start to shape your future. Yet, it’s often during these years that some of the most costly financial mistakes are made, not out of recklessness, but due to a lack of structured planning.

The good news? Many of these missteps are avoidable, provided there’s awareness and timely action.

1. Living Without a Clear Financial Roadmap

The Misstep:

Many professionals earn well in their 30s but operate without a defined plan for saving, spending, or investing. This lack of structure can lead to short-term splurging, inconsistent saving habits, and delayed wealth creation.

A Better Way:

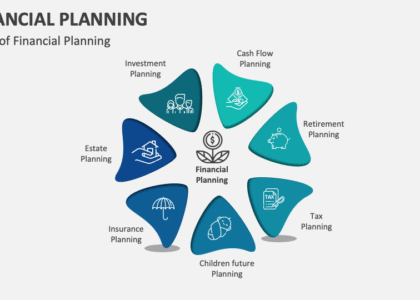

Start by outlining your financial goals, be it buying a home, securing your child’s education, or retiring early. Once goals are defined, back-calculate how much needs to be saved or invested monthly. Clarity brings consistency, and consistency leads to compounding, the very heart of long-term financial success.

Pro Tip: A personalized plan that evolves with your life stage is more valuable than any standard “10-step guide.”

2. Overcommitting to EMIs Without Asset Balance

The Misstep:

Owning a house or car is often considered a milestone in your 30s. But taking on high EMIs without factoring in liquidity or future income stability can lead to financial stress, especially in case of emergencies or job transitions.

A Better Way:

Strike a balance between aspiration and affordability. A smart strategy is to keep all fixed monthly obligations (like EMIs, rent, insurance) under 40% of your monthly income. That leaves room for investments, savings, and unexpected expenses without compromising on lifestyle or peace of mind.

Helpful Hint: A home loan should support your future, not suffocate your present.

3. Ignoring Investment Diversification & Passive Income

The Misstep:

Many in their 30s either rely solely on fixed deposits or, conversely, invest heavily in equities without considering risk appetite. Worse, passive income, the real wealth-building pillar, is often ignored entirely.

A Better Way:

Think beyond traditional tools. Explore real estate-backed investments or monthly income-generating options that provide steady returns with lower market risk. Even with small amounts, starting early sets the tone for long-term financial freedom.

Insight: Those who plant the right seeds in their 30s can enjoy the shade by 40.

4. Not Planning for Medical or Life Uncertainties

The Misstep:

With youth and energy on your side, insurance often seems like a “later” task. But unexpected health issues, accidents, or even job loss can derail years of financial progress. Without adequate protection, families face both emotional and financial strain.

A Better Way:

Secure comprehensive health insurance and a term life cover tied to your liabilities and goals. It’s not just about saving money but protecting everything you’ve worked for.

Silent Truth: Risk management is the foundation of wealth creation.

5. Postponing Expert Financial Guidance

The Misstep:

Many think they’ll “figure it out later” or rely solely on online tips and family advice. But without professional insight, misaligned strategies, wrong product choices, or missed tax benefits are common.

A Better Way:

Getting an expert financial perspective early can change the entire trajectory of your future. It’s not just about where to invest, but how to align every rupee with your vision, safely, transparently, and with accountability.

Realization: DIY is great for hobbies. When it comes to your financial future, expert eyes make all the difference.

A Real-World Reflection

Take two professionals in their 30s earning ₹1.5 lakhs/month. One spends impulsively, saves inconsistently, and delays insurance. The other works with a certified planner, builds a diversified investment portfolio, and earns passive income through real estate-backed strategies. Fast forward 10 years, the difference in lifestyle, stability, and financial confidence is staggering.

It’s not the income, but the decisions that create long-term wealth.

Your Next Financial Decade Starts Now

The 30s aren’t just a phase, they’re a launchpad. A time to correct course, build assets, and create a life where money becomes a tool, not a worry. Each decision, no matter how small, compounds into the future.

Whether it’s starting with ₹1 lakh or redefining your entire strategy, the key is action backed by clarity. As someone navigating career growth, family responsibilities, and long-term dreams, the smartest move is to not walk the journey alone.

Final Thought

Avoiding mistakes is as powerful as making the right choices. Your 30s offer a unique window, filled with energy, ambition, and the opportunity to shape your financial future.

The most successful people don’t do it alone, they plan, protect, and partner with those who understand the terrain.

Click to know More About Aspire Kingdom: https://aspirekingdom.com/

Frequently Asked Questions (FAQs)

Q1. Why is financial planning so important in your 30s?

Because it’s the decade where most life-altering decisions are made, from buying a house to starting a family. Smart planning now ensures stress-free decades later.

Q2. I only earn ₹60,000/month. Is planning still needed?

Absolutely. Planning is about prioritizing and protecting, not just investing large sums. Even small amounts compounded over time yield results.

Q3. What’s a good balance between savings and spending?

A healthy benchmark is 50:30:20, 50% on needs, 30% on wants, and 20% for savings/investments. This can be customized based on your goals.

Q4. Can I start building passive income with just ₹1 lakh?

Yes. Some professionally managed real estate-backed plans offer monthly income from as low as ₹5,000 for a ₹1 lakh investment.

Q5. How often should I review my financial plan?

At least once every quarter. Life goals, markets, and regulations change and so should your strategy.