Thousands of Non-Resident Indians (NRIs) are looking back home, not just emotionally, but financially. With the rising volatility in global markets, the Indian real estate sector has emerged as a lucrative and stable option for NRIs seeking consistent income, wealth creation, and secure assets.

But while the potential is undeniable, the process isn’t always simple.

Whether you’re working in the UAE, the US, or Singapore, the idea of investing lakhs, or crores, in Indian real estate can raise several concerns:

- How safe is my investment?

- Who will manage my property when I’m abroad?

- Can I really earn monthly income, or is this just marketing hype?

Let’s demystify the process and explore how NRIs can invest safely and profitably in Indian real estate, especially with options that provide monthly passive income.

A New Reality for NRI Investors

Over the last decade, NRIs have played a significant role in the Indian real estate market. In fact, NRI investments accounted for over $13 billion in Indian real estate in 2023, a number expected to rise steadily through 2025.

With increased transparency through RERA, digital property transactions, and better developer accountability, real estate is no longer the ambiguous asset it once was. Instead, it’s a regulated, high-return investment, if done right.

The Shift from Appreciation to Income

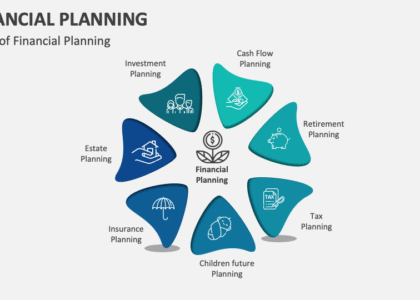

Traditionally, real estate was all about long-term appreciation. You buy, hold, and eventually sell at a higher value. But today’s NRIs are thinking differently. With the rise of financial consciousness and digital tools, the focus has shifted to:

- Monthly cash flow

- Capital protection

- Diversification of income streams

This shift has led to the emergence of real estate-backed passive income plans, tailored specifically for investors who want stability without the daily stress of market fluctuations.

Common Challenges NRIs Face When Investing in India

Despite the opportunities, many NRIs still hesitate. And it’s not without reason.

1. Lack of On-Ground Support

Managing a property from thousands of miles away is difficult. From tenant issues to legal complications, NRIs often feel out of control.

2. Fear of Fraud or Mismanagement

In some cases, NRIs have invested in projects that were delayed, poorly built, or legally stuck due to unclear land titles or unapproved plans.

3. No Clear Return Path

Many real estate investments remain “dead assets”, sitting idle without generating any monthly income or liquidity options.

4. Complex Taxation and Compliance

Understanding the TDS, capital gains, rental income tax, and double taxation agreements (DTAs) can be overwhelming, leading to under-optimized returns.

But there’s a way forward, and it doesn’t involve going through this alone.

A Safer Path: Real Estate-Backed Monthly Income Plans

Imagine investing ₹1 lakh to ₹2 crores in Indian real estate, and getting a guaranteed income deposited in your NRI account each month. No tenants to chase. No agents to manage. No construction delays.

This is not a theoretical idea, it’s a structured, regulated model offered by trusted advisors like Aspire Kingdom in Gurgaon.

These real estate-backed passive income plans work like this:

- Your money is pooled into pre-leased commercial or residential properties

- These properties generate rental income or project-based ROI

- You receive monthly income, while your capital remains secured in appreciating real estate

Let’s look at two common plan types designed for different investor profiles.

Investment Plan Comparison

| Plan Name | Minimum Investment | Monthly Return | Annual ROI | Ideal For |

| Smart Start | ₹1,00,000 | ₹5,000 | 60% | Young professionals, NRI newbies |

| Legacy Builder | ₹2 Crores | ₹1,60,000+ | 48% | HNIs, Retirees, NRI entrepreneurs |

These are not high-risk, speculative schemes. These plans are:

- Real estate-backed

- Transparent and record-maintained

- Low-risk, high-trust models

- Professionally managed

How Security is Ensured for NRIs

With Aspire Kingdom, every investment is tied to a physical, appreciating asset in Gurgaon or surrounding high-growth areas. Here’s how your capital stays protected:

1. Title-Vetted Properties Only

Only projects with clear legal titles, builder track records, and RERA registration are selected.

2. Digitally Managed Returns

No manual follow-ups. Monthly income is credited automatically to your designated account.

3. Quarterly Reviews and Audits

Your plan is reviewed quarterly and adjusted based on market performance or your evolving goals.

4. Dedicated Relationship Manager

You are assigned a direct point-of-contact, someone who understands both Indian real estate and NRI investor concerns.

Read Also: M3M Crown – Sector 111, Gurgaon

Real Case: From Dubai to Gurgaon – NRI Success Story

Take the example of Rohan, an IT consultant based in Dubai. He wanted to invest ₹20 lakhs in India but feared mismanagement. After connecting with Aspire Kingdom, he opted for a ₹10 lakh Smart Start plan.

Within 45 days, he received his first ₹5,000 passive income. Today, he earns ₹25,000/month with 5 small investments, while his principal continues to grow.

What changed?

- Clear communication

- Regulated asset selection

- No brokerage drama

- Safe, monthly return

What You Need to Get Started

For NRIs considering investment, the onboarding process is simple:

- Valid NRI ID (OCI/Passport)

- NRE/NRO bank account

- Investment KYC form

- Digital onboarding with Aspire Kingdom’s advisor team

We recommend starting with a small amount to test the waters. Once you’re comfortable, you can scale gradually.

Final Thoughts: Build Income, Not Just Assets

The future of NRI investment in India lies in predictable, passive income, not in waiting decades for appreciation or managing distant properties.

Today’s Indian real estate market has evolved. So should your investment approach.

With curated opportunities, real-world results, and transparent operations, platforms like Aspire Kingdom are changing the way NRIs grow wealth, safely, smartly, and sustainably.

If you’re ready to turn your hard-earned income abroad into steady returns back home, it’s time to explore real estate-backed investment strategies that work while you don’t.

Ready to Take the Next Step?

Speak with a Certified Investment Advisor at Aspire Kingdom

📍 Sector 65, Gurgaon

📞 Call/WhatsApp: +91 8738017295

🌐 Website: www.aspirekingdom.com

Frequently Asked Questions (FAQs)

Q1. Can NRIs legally invest in Indian real estate?

Yes, NRIs with an OCI card or valid passport can legally invest in residential or commercial properties (except agricultural land) in India.

Q2. How do I receive my monthly income abroad?

You can receive income in your NRO account or repatriate funds abroad through proper compliance under FEMA guidelines.

Q3. Is there any tax on the rental income or returns?

Yes, TDS may apply, and NRIs must file returns. Aspire Kingdom provides tax-efficient planning assistance and legal support.

Q4. Can I start with ₹1 lakh and scale later?

Absolutely. Many NRIs begin with small ticket sizes to test the model and then increase investment once they are confident.

Q5. What if I want to exit the investment?

Depending on your plan, exit options include resale, transfer, or maturity-based returns. Aspire Kingdom assists with smooth offboarding.