Investing in property is one of the biggest financial decisions you’ll make. But in 2025, with the Indian real estate market evolving rapidly, many property buyers fall into common traps that lead to financial loss, legal complications, and lifelong regrets.

At Aspire Kingdom, we believe knowledge is power. Whether you are buying your first home, investing for rental income, or purchasing a second property, knowing what pitfalls to avoid will make your property investment journey smoother, smarter, and more profitable.

Let’s explore the Top 10 Biggest Property Buying Mistakes and learn how you can avoid them.

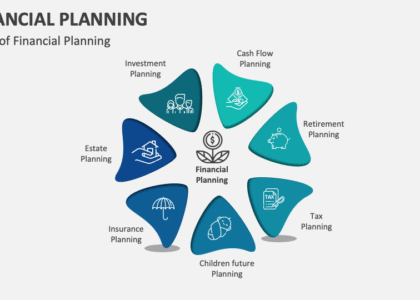

1. Inadequate Financial Planning and Budget Assessment

Many property buyers focus solely on the purchase price while ignoring hidden costs. Buying a home doesn’t stop at paying the listed price.

Common Mistake:

Ignoring registration fees, stamp duty, legal costs, maintenance, renovation, and property taxes.

How to Avoid It:

- Prepare a complete cost of ownership estimate (8–12% of property price).

- Maintain an emergency fund of at least 20% of your budget.

- Factor in regular costs like maintenance, insurance, and property taxes.

- Consider interest rate fluctuations if you’re using a home loan.

Pro Tip: Plan for all these costs before making a decision to avoid unpleasant surprises.

2. Ignoring Location Research and Neighborhood Analysis

The location of your property defines your lifestyle and the asset’s future value.

Common Mistake:

Buying without proper analysis of the neighborhood.

How to Avoid It:

- Visit the area at different times of day and week.

- Check accessibility to schools, hospitals, transportation, and daily necessities.

- Research future infrastructure projects.

- Analyze crime and safety data.

- Look for long-term growth potential and resale value.

Remember: The right location ensures both comfortable living and investment appreciation.

3. Skipping Legal Due Diligence

One of the costliest mistakes is neglecting legal checks, risking future property disputes or tainted titles.

Common Mistake:

Assuming the seller is legitimate without verification.

How to Avoid It:

- Hire a trusted real estate lawyer.

- Ensure the title is marketable and clear.

- Check all necessary approvals, completion certificates, and NOCs.

- Verify the seller’s authority to sell.

- Inspect sale deeds, tax receipts, and encumbrance certificates.

Tip: A little effort now avoids major legal hassles later.

4. Not Understanding Property Documentation

Many buyers sign documents without full knowledge of what they’re agreeing to.

Common Mistake:

Overlooking the need to thoroughly check legal documents.

How to Avoid It:

Have a checklist ready:

- Title documents & sale deed

- Property tax receipts

- Completion certificate

- NOCs from authorities

- Encumbrance certificate

- Mutation records

- Society formation papers (if applicable)

Pro Tip: Never buy a property without a complete set of valid documents.

5. Ignoring Risk Management and Insurance

Many first-time property buyers do not think about insurance coverage.

Common Mistake:

Assuming the property is protected just by ownership.

How to Avoid It:

- Opt for house insurance covering structure and contents.

- Consider title insurance to protect against legal disputes.

- Include natural disaster coverage.

- Maintain updated records and property valuation reports.

Smart Move: Insurance acts as a safety net for unexpected events.

6. Insufficient Market Research and Price Comparison

Rushing into a deal without comparing similar properties often leads to overpaying.

Common Mistake:

Agreeing to the first quoted price without research.

How to Avoid It:

- Compare similar properties on trusted online portals.

- Check market trends in that area.

- Speak to local real estate brokers for insights.

- Factor in market cycles and seasonal trends.

- Negotiate based on informed data.

Pro Tip: Never settle without price comparison.

7. Overlooking Ongoing Costs

Many buyers think only of the initial price and ignore ongoing expenses.

Common Mistake:

Ignoring costs such as maintenance, property tax, and utilities.

How to Avoid It:

- Calculate monthly maintenance fees and property tax.

- Consider utility connections and future repairs.

- Don’t forget insurance premiums and parking fees.

- Factor in property management costs if it’s for rental purposes.

Full cost visibility ensures smarter decisions.

8. Rushing the Process

Buying property under time pressure leads to poor decisions.

Common Mistake:

Not taking adequate time for due diligence and market research.

How to Avoid It:

- Visit properties multiple times.

- Avoid imaginary deadlines or “limited period offers.”

- Consult multiple experts.

- Consider seasonal and market factors.

- Allow time for documentation and approvals.

Tip: Patience pays off in property buying.

9. Neglecting the Importance of RERA

RERA (Real Estate Regulatory Authority) is critical for property safety in India.

Common Mistake:

Buying properties without RERA registration.

How to Avoid It:

- Always verify RERA registration number.

- Check project progress and status online on rera.gov.in.

Pro Tip: RERA protects your investment from builder fraud and delays.

10. Emotional Decision-Making

Many buyers make the mistake of letting emotions overpower logic.

Common Mistake:

Choosing a property because “it looks beautiful” or “I fell in love with it.”

How to Avoid It:

- Make decisions based on data, not emotion.

- Compare multiple properties objectively.

- Evaluate location, price, legal compliance, and future growth.

Pro Tip: Rational decision-making leads to smarter investments.

Why Choose Aspire Kingdom?

At Aspire Kingdom, we specialize in guiding you to avoid these common property buying mistakes. With our:

- Expert advice based on years of experience

- Goal-based, personalized investment plans

- Real estate-backed models for safe, high returns

- Full support from property search to documentation

We help you make informed and secure property investments in Gurgaon and across India.

📩 Message us “HOMEPLAN” today and get your personalized property buying strategy.

📞 Call: +91 87380 17295

🌐 Visit: www.aspirekingdom.com

Final Thoughts

Property buying is a significant financial decision. Avoiding these 10 common mistakes can save you from financial loss and legal troubles. Whether you’re a first-time buyer or an experienced investor, a professional advisor like Aspire Kingdom can help you navigate this complex process, ensuring safety, profitability, and peace of mind.

👉 Don’t take property investment lightly. Let us help you achieve your dream property in 2025.

Top 10 SEO-Optimized FAQs – Property Buying Mistakes in India

1. What are the most common property buying mistakes in India?

Common mistakes include ignoring legal due diligence, poor financial planning, overlooking location research, and skipping document verification, which lead to financial loss or legal troubles.

2. How can first-time homebuyers avoid property buying mistakes in India?

First-time homebuyers should plan their budget properly, research the neighborhood thoroughly, verify legal documents, compare property prices, and consult certified real estate experts.

3. Why is legal due diligence important before buying property in India?

Legal due diligence ensures the property has a clear title, all approvals are in place, and no pending disputes exist. It helps prevent fraud and future litigation.

4. What role does financial planning play in property buying?

Without proper financial planning, buyers may ignore hidden costs like stamp duty, registration fees, maintenance, and taxes, leading to financial strain post-purchase.

5. Is RERA registration important while buying property in India?

Yes, RERA registration ensures the builder follows regulatory guidelines, provides project completion guarantees, and protects buyers from fraud and project delays.

6. How to avoid location-related mistakes when buying property in India?

Research proximity to schools, hospitals, transportation, safety, future infrastructure plans, and visit the neighborhood at different times to assess livability and growth potential.

7. What happens if I buy property without checking the encumbrance certificate?

Skipping the encumbrance certificate check can result in purchasing a property with existing loans or legal disputes, potentially leading to loss of ownership or costly legal battles.

8. How do I manage property-related hidden costs effectively?

Calculate the total cost of ownership before purchase: property tax, maintenance fees, registration, stamp duty, insurance, renovation, and property management charges.

9. Why should I avoid emotional decisions when buying a property?

Buying property based solely on emotions leads to poor financial choices. Rational decision-making backed by research helps in choosing the right property aligned with long-term goals.

10. Who can help me avoid property buying mistakes in India?

Certified real estate consultants like Aspire Kingdom in Gurgaon provide expert guidance, market insights, and personalized investment strategies to help you make informed, mistake-free property purchases.