Buying a dream home, giving your children the best education, retiring early, or traveling the world are goals that most of us share. But dreams alone are not enough. To turn them into reality, we need a clear financial plan.

This is where financial planning plays a vital role. At Aspire Kingdom, our mission is simple: make your money work for you. We help you create a strategy that balances your income, expenses, investments, and goals so you can enjoy life with financial freedom and peace of mind.

In this guide, let’s explore what financial planning is, why it’s important, what the different types of financial planning are, and how you can start your journey today.

What Is Financial Planning?

Financial planning is the process of managing your money wisely to achieve both short-term and long-term goals. It includes:

- Income & Expenses

- Savings & Investments

- Taxes & Insurance

- Debt & Assets

In simple terms, it’s like a roadmap for your money. Without a plan, you’re just driving blind. With a plan, you know where you are, where you’re going, and what the best route is to reach your destination.

At Aspire Kingdom, we provide personalized financial strategies based on your age, income, goals, and risk tolerance, so that your plan reflects your life, not someone else’s.

Why Is Financial Planning Important?

Are you still wondering if you really need a financial plan? Know why it is important:

1. Maximises Returns & Minimises Taxes

A smart financial plan ensures that your money works hard by investing in growth options and minimising your tax liability.

2. Gives You Clarity

When you track income, expenses and investments, you are able to have a clear understanding of your financial position and make better decisions.

3. Protects You From Emergencies

Life is unpredictable. A plan ensures that you are prepared for medical bills, job loss or unexpected expenses without panicking.

4. Personalised Investing

Everyone has different dreams. A personalized plan matches your goals and risk profile, rather than haphazard investments.

5. Peace of Mind

Money is one of the biggest sources of stress. A well-planned plan takes the guesswork out and gives you confidence about the future.

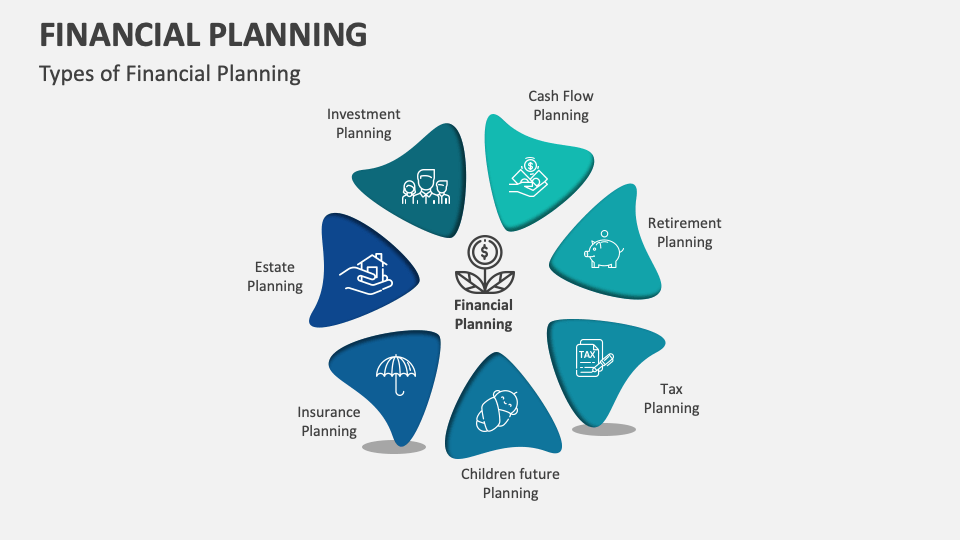

Types of Financial Planning

There are different areas of financial planning, and each area focuses on a specific need. Here are the things you should know:

1 Budgeting

Creating a budget is the foundation. It helps you track how much money comes in, how much goes out, and how much is left over for savings. Following the 50/30/20 rule (50% needs, 30% wants, 20% savings) can be a good start.

2 Debt Management

Loans and credit cards are a part of modern life. But uncontrolled debt can weaken your financial position. Financial planning helps you:

- Avoid unnecessary loans

- Repay smartly

- Improve your credit score

3 Emergency Planning

A separate emergency fund is a must. It covers at least 6 months of your basic expenses in case of job loss, health issues or unexpected expenses. This fund saves you from breaking your investments or taking high-interest rate loans.

4 Investment Planning

This is the essence of financial planning. Investment planning makes money grow instead of letting it sit idle. It takes into consideration:

- Your goals (house, retirement, child’s education)

- Your risk tolerance (conservative, balanced, or aggressive)

- Your time horizon (short-term vs long-term)

Diversification is key. At Aspire Kingdom, we guide clients on real estate-backed investments, mutual funds and monthly income plans for both protection and growth.

5 Insurance Planning

Emergencies are costly. Insurance protects you, your family and your assets.

- Health Insurance: Covers hospital expenses

- Life Insurance: Protects family in your absence

- Asset Insurance: Safeguards home, car, or valuables

Without insurance, a single emergency can wipe out years of savings.

6 Tax Planning

Why pay more taxes than necessary? Strategic tax planning ensures that you avail all deductions and exemptions legally. This will enable you to save more, invest more and grow your wealth faster.

7 Retirement Planning

If you want to enjoy your golden years stress-free, start retirement planning early. The sooner you start, the more you will benefit from compound interest. Retirement planning includes the following:

- Your lifestyle expectations

- Rising healthcare costs

- Inflation

- Desired retirement age

At Aspire Kingdom, we help create retirement strategies that provide both security and freedom.

8 Estate/Legacy Planning

Plan the distribution of your assets to ensure your family gets what you want, without any legal disputes. This includes:

- Nominations

- Wills

- Trusts

It’s all about protecting your hard-earned assets for generations to come.

4. Tips for Effective Financial Planning

Here are some simple yet effective tips:

- Live within your means

- Track your net worth regularly

- Avoid unnecessary debt

- Prioritise savings before spending

- Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound)

- Keep an emergency fund

- Start retirement planning early

- Review your plan at least once a year

How Aspire Kingdom Helps You

At Aspire Kingdom, we don’t just offer advice, but also create implementable, risk-managed plans tailored to your needs.

- Smart Investment Plans Starting from ₹1,00,000

- Monthly passive income options up to ₹5,000/month on an investment of ₹1 lakh

- High ROI real estate-backed model (48-60% p.a.)

- Trusted Guidance by Abhishek Katiyar (8+ Years, Serving 800+ Happy Families)

Whether you are looking for tax savings, steady monthly income, or long-term wealth – we will help make your money work for you.

Call to Action

Ready to take control of your financial future?

Call us at +91 8738017295 or visit: www.aspirekingdom.com

Get Your Free Financial Consultation Today!

Conclusion

Financial planning is not a luxury, but a necessity. From budgeting and investing to retirement and legacy planning, every step matters. With expert guidance from Aspire Kingdom, you can turn your financial dreams into achievable goals.

- Don’t wait until it’s too late. Start planning today.

- Visit us: Sector 65, Gurugram, Haryana

- Email: hello@aspiraspirekingdom.com